Navigating HOA Insurance In Today’s Environment

Planning for Insurance Risk

As insurance costs are rising - and the levels of insurability continue to be challenging for Homeowners Associations (HOAs) - how do boards plan (and negotiate) for the rising costs, risks, along with addressing deferred maintenance while securing the appropriate amount of insurance coverage? “Comprehensive” insurance coverage - including minimum levels of legally required coverage - protects the board, HOA members, and home values against a range of risks and liabilities. As HOA insurance is a specialized and nuanced area of insurance, it is critical for the board to understand key insurance coverages and how those relate to the HOA management structure, community, fluid property values, and requirements of HOA governing documents.

Insurance requirements are state-driven. States require HOAs carry a minimum of coverage including General Liability (provides protection from claims of bodily injury, property damage, and personal injury in common areas the association is responsible); Directors & Officers (as the name states - protects board members (directors) from lawsuits related to their governance of the association – while Errors & Omissions policies protect more than directors - any representative of an HOA - for failing to provide adequate professional services); and Fidelity/Crime (provides coverage for losses from fraud and dishonesty, protecting the association’s capital against embezzlement or other criminal acts – board members, employees, management. Underwriting is determined by the association's size, financial management controls, and claims history.)

Not required, but common for associations is to purchase “Umbrella” coverage - as the word implies – umbrella policies cover gaps between GL and D&O and is a cost-effective way to access limits above the primary GL and D&O levels (and is broader in coverage than an “excess policy” – which expands the financial limits of a policy – while an “umbrella” expands the terms or scope of a policy and provides broader coverage for losses not outlined in an underlying policy). Adding Umbrella protection where appropriate ensures that HOAs and boards can confidently navigate situations where liabilities extend beyond the confines of their primary insurance, offering a robust financial safeguard against unforeseen and significant claims. This brings up an important aspect of insurance governance – part of boards’ fiduciary duties – COI tracking – or “Certificate of Insurance” tracking. Managing excess and umbrella policies adds another layer of complexity to an already challenging certificate of insurance tracking process, which involves monitoring and verifying insurance certificates from vendors to ensure compliance with specific requirements, which can be manual and time-consuming. If underlying policies do not meet minimum requirements, excess or umbrella policies may not execute as expected, creating potential liability gaps. There are automated and AI solutions that can aid in the tracking process – but ultimate responsibility to obtain and understand proper coverages fall on the board.

It is obvious that a Workers’ Compensation (WC) policy would be required if an association has direct employees on its payroll. What is less obvious – but equally important – is to consider a WC policy even of the HOA employs no direct employees. The risk here is that a vendor’s employee could sue the HOA for injuries sustained on the job – and holds the HOA liable for compensatory damages under the state’s workers' compensation laws. If the board opts out of this coverage, they must verify any subcontractor's licenses and insurance as current at all times to avoid financial liability for any worker injuries in the event of a complaint.

Another increasingly important coverage for HOAs is Cyber. The proliferation of personal and property data sharing and exposure makes this coverage all the more relevant for HOAs and boards to secure as part of HOAs’ comprehensive insurance programs. Cyber is a specialized insurance policy that protects board and HOA members from the financial and operational impacts of cyberattacks, data breaches, and other digital incidents. Most associations have an online presence, where members can pay dues, review minutes, etc. on the HOA’s website. Most sites require a login and password from members to view personal and financial information, in addition to association business and minutes. With or without requiring logins, any association with a digital presence is at risk of data breaches, hacks, or ransom incidents where leaked or compromised information could result in financial and/or reputational damage in the form of lower property values - and even identity theft, if indirect PII (Personally Identifiable Information) is posted (email addresses of board or HOA members, their phone numbers and addresses, as examples). Posting meeting minutes online password protection is a huge risk that could lead readers to form a negative perception of how the property is managed and decide against buying property there. This view could quickly spread online through social media, leading to major damage to reputation and property values – and even HOA revenues – for those HOAs that require buy-in fees of new homeowners who purchase into an HOA.

A tangent of maintaining appropriate coverages and policies – another important question arises for boards: How do lenders’ lending requirements and reserve studies inform negotiations between boards and HOA insurance carriers? As lenders use reserve studies to ascertain HOA maintenance and schedules – there is a direct correlation between the condition of a property and the lendability of it – which informs the risk factors of the property – which is key to insurance carriers’ rate and premium setting. One of the most important and relatively easy things a board can do to set the time for carrier negotiations is to inform the HOA’s insurance carrier of any and all property maintenance and capital improvement early and often. This can be done by simply sending photographs documented on smart phones or using drone technology to provide more comprehensive photographic coverage of property improvements.

As a board member preparing to sit down with the broker for the annual check-in: how should the conversation be framed to arrive at accurate - and not inflated - levels of coverage needed for the HOA? There are two factors to consider: 1. Lenders’ insurance coverage requirements; and 2. The unique needs of the HOA – of which the HOA management model, age and condition of structures, amenities, property location/geography, and financial demographics of the HOA members - should all be factors. (To complicate things a bit more –coverages based on property attributes and rates (premiums), do not always corelate linearly. “Social inflation” will be addressed later.)

For consideration #1, lenders’ coverage requirements, aside from the necessary insurance policies, mortgage lenders often require coverage and limits above/outside statutory minimums. In California, for example, HOAs need to have 100% of replacement cost basis “RCV” coverage for common areas, and a minimum of $2M in general liability for 100 separate interests (deeded dwellings), and $3M for anything above that.

Of note: the HOA master property insurance policy typically must provide for claims to be settled on a replacement cost basis “RCV”. Property insurance policies that provide for claims to be settled on an actual cash value “ACV” basis are not desirable – and claims on ACV can be denied by certain lenders. Policies that limit, depreciate, reduce or otherwise settle losses at anything other than a replacement cost basis are also not advisable.

This brings up another relevant aspect of assessing proper coverage: RCV. How is property RCV obtained? Doing due diligence as a board member on the construction bids and construction inflation is key to developing a ROM (rough order of magnitude) on what replacement costs could be – and by extension – provide leverage when negotiating appropriate coverages with carriers.

Earthquake and flood protection are important coverages that – while not legally required on some states - respond when physical assets of an association are damaged by an earthquake or flood event. These perils are excluded from a standard property policy, so must be purchased separately. As it is the board’s responsibility to protect the association’s assets, it can be difficult to secure this coverage if the property is located in a high-risk zone. In states such as California, it can be challenging to secure appropriate limits with deductibles and premiums an association can live with. This presents another opportunity for the board to utilize its reserve study to analyze and budget for such expenditures. Can the association's capital support a higher deductible to lower annual premiums? If the association does not purchase earthquake and/or flood coverage, and a catastrophic event occurs, members of the association could file lawsuits against the HOA for damage or loss to their individual structures if there aren’t adequate funds to make the necessary repairs. The association choosing to be “self-insured” (no insurance protection) could adversely impact underwriting from mortgage lenders, making it difficult or impossible for members to sell their units when buyers use specific lenders. Insurance choices outside local markets include Lloyd’s of London, a facility that offers coverage and pricing alternatives through its member insurers.

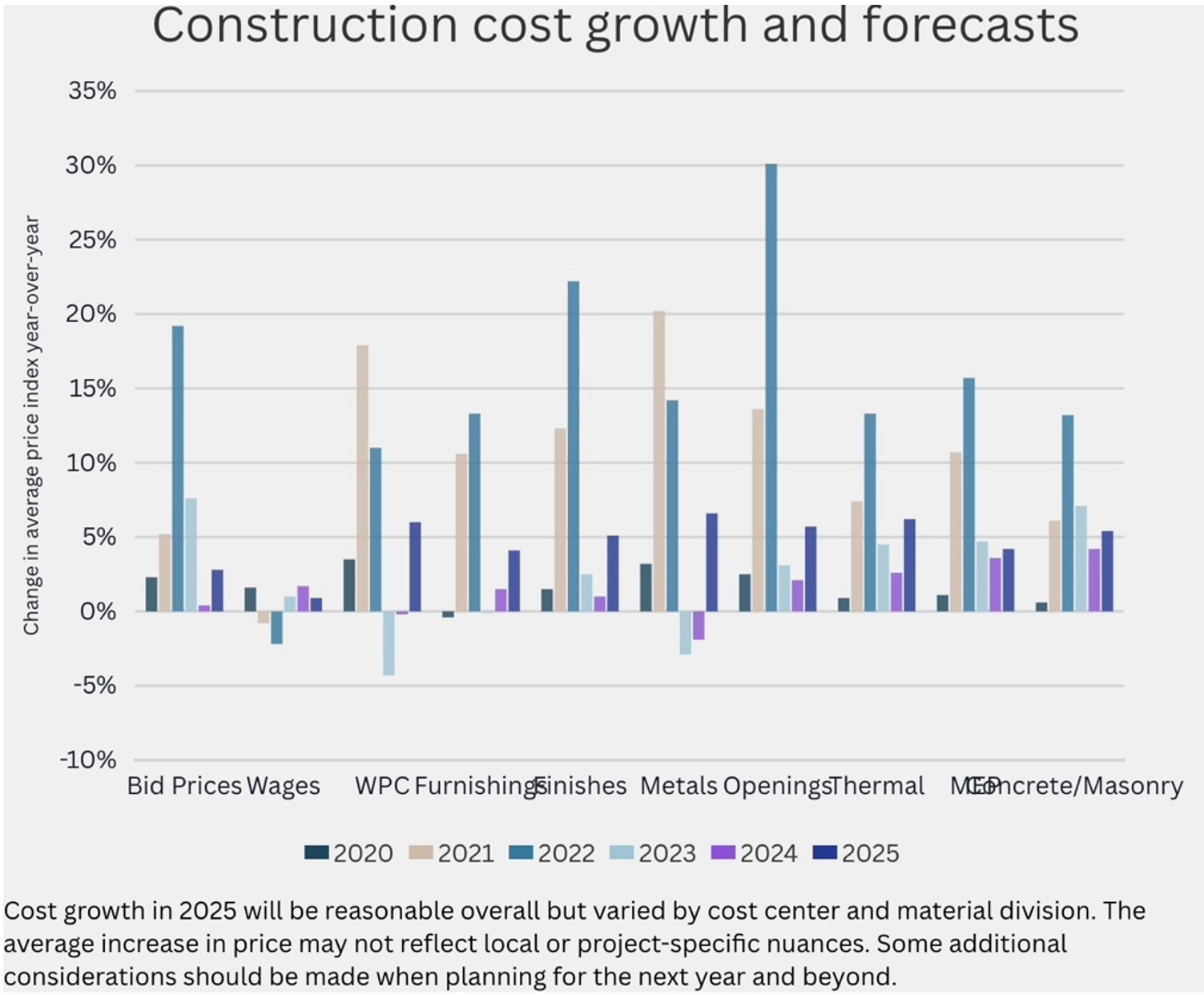

It would be remiss not to call out other factors impacting rising insurance costs for HOAs. Recent tariffs are beginning to play into higher insurance premiums. For instance, property policies usually include “Replacement Cost Value” (RCV) as discussed above - meaning the policy pays the costs to replace damaged or destroyed property at today’s prices, versus, “Actual Cash Value” (ACV), which pays the replacement cost after subtracting depreciation due to age or wear and tear. (Current) replacement costs have been increasing due to higher general inflation (construction lending), decreased labor pools, and higher costs of materials compounded by disrupted supply chains, caused by geopolitical tensions, and exacerbated by tariffs. Construction inflation (commercial sector, multi-family) from 2019 to 2025 experienced a compounded annual growth rate (CAGR) of between 12%-15%, per Mastt research. This year, Jones Lang LaSalle’s 2025 US Construction Outlook expects cost growth to be between 5% and 7%.

Source: JLL, https://www.jll.com/en-us/insights/market-outlook/us-construction 2025

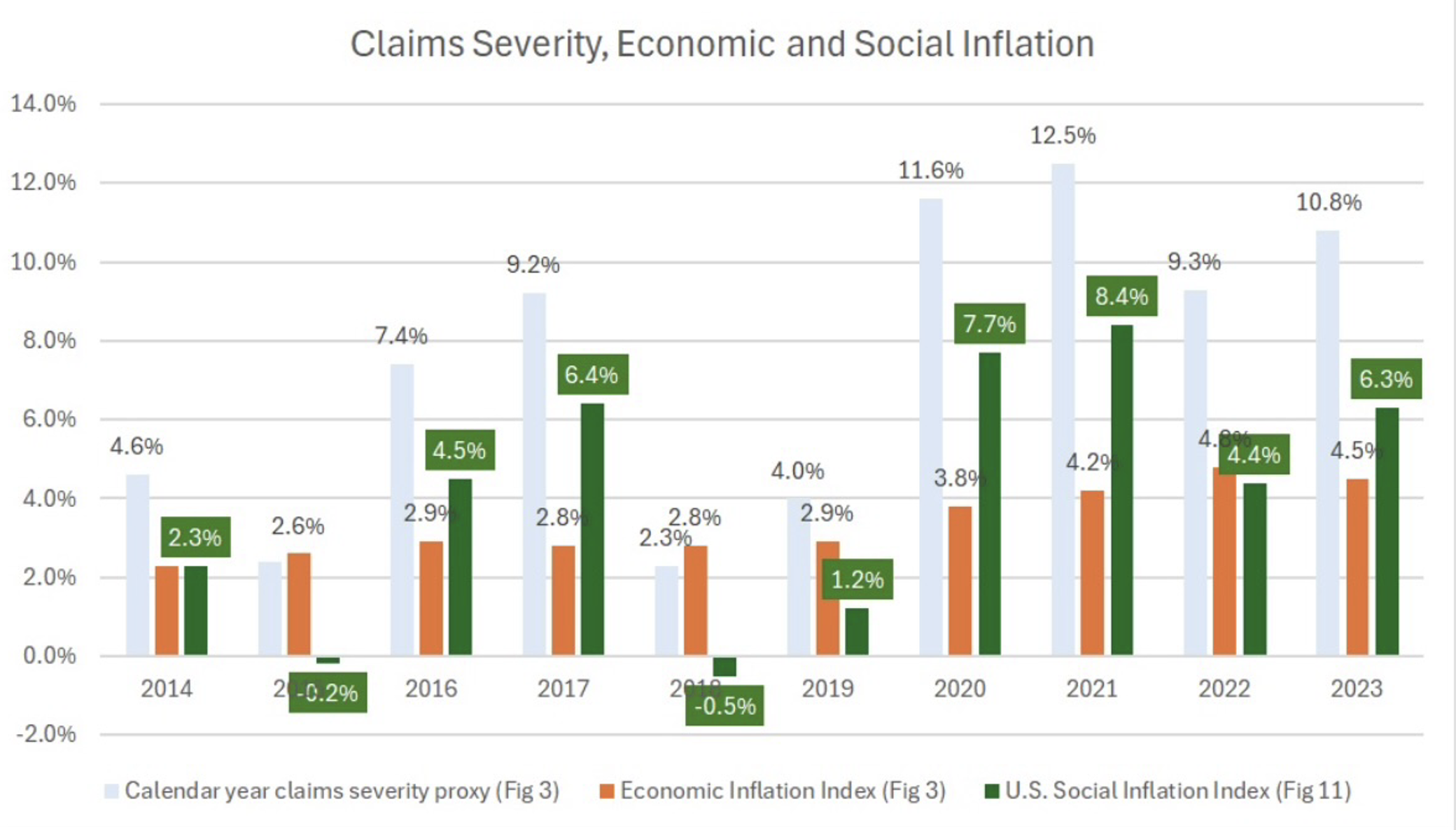

Back to social inflation. How do HOAs handle rising insurance costs? Social Inflation is an ongoing concern in the insurance arena that is impacting the commercial insurance industry as it relates to the increasing cost of claims that are outpacing overall economic inflation. This is happening through increases in litigation, occurrences of large jury verdicts (often referred to as "nuclear verdicts"), a rise in litigious behavior among homeowners, and juries demonstrating greater sympathy toward homeowners. This trend significantly impacts the cost of General Liability, Umbrella, and Directors & Officers coverages that are critical components of a HOA’s insurance program. The results are higher claim costs for insurers, which are passed on to its customers in the form of increased premiums. Outside of an association’s own risks and exposures, it is critical for a board to understand how these costs can directly affect the financial health of an association with non-controllable exposures that are driving up costs in the insurance industry.

Source: Carrier Management, November 22, 2024 https://www.carriermanagement.com/features/2024/11/22/268927.htm

What are the steps boards can take to offset the risks arising from social and material inflation? It’s multi-fold, consisting of 5 critical elements:

1. Developing A Spending Strategy: This involves utilizing reserve studies to identify high- and low-risk areas – and sequencing their financial outlay accordingly, while identifying areas for potential cost savings (low priority components).

2. Fostering Relationships With Vendors: Building strong relationships with suppliers can help secure more favorable prices and improve vendor commitment and reliability.

3. Purchasing Materials/Services At Scale: When feasible, purchasing products/services at scale can help lock in prices and mitigate the risk of future price increases.

4. Proactively Maintaining Property: Timely maintenance of property can extend its lifespan and reduce the need for costly replacements during periods of high inflation. Look at the reserve study and inspect the property components in real time to determine repair/replace priorities.

5. Long-term Outlook For Procurement (LOIs) – Purchasing in advance at fixed or favorable pricing when possible to secure availability, stabilize costs, and ensure project timelines remain intact.

In addition to understanding the current condition of the property, its capital improvements, risk-mitigating features, high- and low-priority maintenance aspects, and the ability of its members to absorb financial events, and its location implications, for effective conversations with HOA insurance carriers, boards should have:

1. Five years of loss information

2. Statement of property values (limits for buildings, contents and business interruption)

3. Construction details of the buildings (age, type of construction, square footage, updates on roof, wiring and plumbing)

4. Protective features of the building(s) (automatic sprinkler system, impact glass, etc.)

5. Copies of formal policies, procedures, disaster preparedness plans, etc.

6. A recent property appraisal.

A Homeowners Association is a business – period. Boards have a fiduciary duty to effectively manage the HOA’s balance sheet, property standard of care, and livability for members – and not least - its insurance obligations. Boards that take the steps outlined here and possess a comprehensive understanding of the HOA and property – utilizing the reserve study as a foundational document – will be successful at not only securing the appropriate amount of insurance coverage for the HOA, but at developing a comprehensive insurance program that protects from risks both obvious and unseen.